Is Barter Really Better? Round Two ...

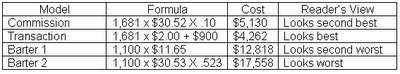

Here are the numbers they used to refute our statements that the costs were not applied equally and the comparison was apples to oranges:

This was our email response to the author:

------------------------------------------------------------------------

With all due respect, we are tracking your math and just don’t agree with it or the way you presented it in OTR [Outside The Ropes]. We are going to recap something from the OTR article in hopes you will understand why your readers were mislead by your math.

“…Course Utilization is about 52.3%, which means that the average golf course theoretically has about 48% unsold inventory available to target for better marketing or for "bartering". Most golf course operators tend to view this unused inventory as having a "zero cost basis", so most bartering starts with the assumption that what they are exchanging has no value.”

The above paragraph is the key to how the reader will interpret your cost comparison. You are stating that the barter rounds come from the 48% unsold inventory; that is why course operators view them as having a zero cost basis and no value. The reader expects that you are now going to show how they do have a cost (and are even more costly than commission or transaction fees).

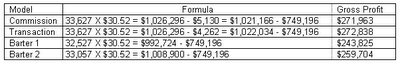

So if the barter is coming from the 48% unsold inventory here is what the numbers should have looked like in the email you sent us:

You said the cost for barter was $12,818 (not $0 as shown above). But if we replace the $0 with $12,818 we would have a problem, we would be double counting some of the fixed costs and comparing apples to oranges in the partner cost comparison; just like we said you did in our blog.

So, in order to support your partner cost comparison in OTR with the numbers in your email, you took 100% of the barter (1,100 rounds) away from the “Rounds Sold for Course” side of the equation; directly contrary to what you stated in OTR.

But even this is not fully consistent with your cost comparison in OTR; you said the cost was $12,818. But that is only part of what the course is loosing, if they would have sold the barter rounds then the loss (using your numbers) would be $33,572. Why did you not state that in OTR?

In the Barter 2 comparison you take about 52% of the barter rounds away from the “Rounds Sold for Course” (instead of 100%); leaving 48% sold for the course.

This is actually a better deal for the course, but you make it look worse in your OTR cost comparison, further confusing the reader.

As we stated in the blog, the most important question is whether the course would have sold the time or not. If they would have sold it, not only can you apply the cost ($11.65) but you should also apply the value the course would have received for the time. If the course would not have sold the time you cannot assign a fixed cost to it and compare that cost with other variable commissions.

------------------------------------------------------------------------

We have enlisted our yield management consultants (Cambio Partners) to also respond to the article. They will present a much more detailed analysis and provide an accurate model for determining the cost of bartered rounds in our next blog.

0 Comments:

Post a Comment

<< Home